Nuclear! Nuclear!! Ethiopia plans two new reactors; South Africa readies a full value-chain reboot

Welcome to the Africa Energy Weekly by Electron Intelligence, your Tuesday-morning briefing on Africa's energy markets.

We track the signals that move value: deal flow, regulation and policy, mega and micro grid projects, and financing trends—and translate them into clear implications for operators and investors. Expect concise analysis, sourced links, and practical takeaways you can act on this week.

It's been a consequential week for nuclear across the continent. At the inauguration of the Grand Ethiopian Renaissance Dam (GERD), Prime Minister Abiy Ahmed said Ethiopia will pursue nuclear power, with plans for two units of ~1,200 MW each targeted between 2032–2034 as part of a broader $30 billion infrastructure push (airport, oil & gas, fertilizer).

The government appears to be moving beyond rhetoric into program design and partner engagement. Earlier this year, Ethiopia entered into three-year bilateral relations with Russia on nuclear cooperation, including an agreement with Rosatom for establishing the Center for Nuclear Science and Technology (CNST). This implies the scaffolding for capability building is already in motion.

For investors and OEMs, the key gating items to watch in Addis Ababa over the next 12–18 months are:

Designation of a competent program owner and financing model (state-led Engineering, Procurement, and Construction (EPC), Build-Own-Operate (BOO) variants, or supplier-credit-heavy structures.

IAEA-aligned milestones on nuclear infrastructure (siting, regulatory independence, human capital, contracting). CNST in focus.

Whether vendor competition is opened beyond the current Russia track to include other large Pressurized Water Reactor (PWR) suppliers or Small Modular Reactor (SMR) options for earlier delivery and modular capex phasing.

South Africa, meanwhile, used the World Nuclear Symposium to announce plans for a 10 GW expansion of new nuclear energy capacity and to restart the Pebble Bed Modular Reactor (PBMR) program, to become "self-sufficient in the entire nuclear value chain". Policy continuity is still the risk factor: last year's legal challenges stalled the procurement process (RFP) for the 2.5 GW new capacity announced in 2023. Officials say the government is exploring both large reactors and SMRs, plus domestic fuel fabrication at Pelindaba, as part of an industrial-policy play.

On operations, Koeberg Unit 1 is expected back from long-term maintenance this month, restoring ~930 MW and improving reserve margins as summer approaches. Taken together, Pretoria is signaling that nuclear is back on the table, not only as capacity, but as an industrial ecosystem play.

One thing is sure - nuclear energy is part of Africa's energy future.

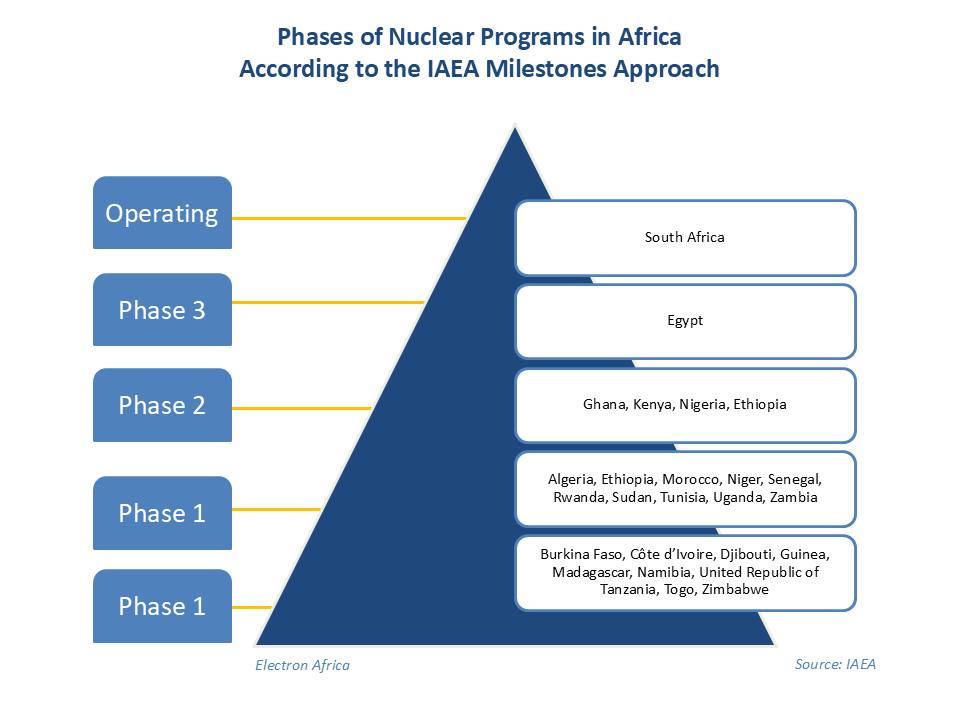

South Africa is the only African country with an operational nuclear power plant (NPP) -Koeberg Nuclear Power Station, which has a combined capacity of 1854 MWe from its two reactors. Egypt is building a four-unit plant, scheduled to be ready by 2028. Ghana, Nigeria, Kenya, and Ethiopia have all announced intent for new nuclear projects, and over a dozen other African countries are currently considering nuclear as an option.

IAEA's Outlook for Nuclear Energy in Africa projects that nuclear capacity on the continent could double by 2030 and grow fivefold by 2050, in a low-case scenario. In a high-case scenario, nuclear capacity could triple by 2030 and increase tenfold by 2050, requiring over $100 billion in infrastructure investment.

One of the biggest challenges to nuclear deployment is public acceptance and institutional backing. Well, that is changing at a global level, and Africa is not left behind. World Bank's reengagement in nuclear power in partnership with IAEA follows a trend of the changing perspectives of multilaterals at scale. This signal will drive institutional investments in nuclear on the continent.

Why it matters:

Uranium Endowment: Three of the top ten global uranium producers are in Africa. Uranium is a critical raw material in the generation of nuclear energy.

Industrial spillovers: Localization of fuel-cycle, component manufacturing, and services can deepen skilled jobs and exports.

Financing reality check: Vendor financing and export credit will be pivotal; bankability will hinge on credible regulators, safety standards, and proven delivery partners.

Regional power trade: Firm capacity enables more reliable exports across EAPP/SAPP links, smoothing variability and drought risk.

Deals & Investment

Nigeria — BII x Odyssey $7.5m mini-grid facility (DARES): British International Investment backs Odyssey's procurement/working-capital platform to accelerate mini-grids tied to Nigeria's World Bank-supported DARES program (targeting ~17.5 m people). Press Release

Senegal — $300m solar for agriculture framework: Dakar signed a framework partnership to deploy solar-powered systems across farms, aquaculture, and processing—an ag-energy productivity play with BOT elements. Energy Capital & Power

Kenya — Centum ups stake in Akiira Geothermal: Centum increases ownership (to ~85%) via a $1.8m buyout, aiming to unlock a stalled Rift Valley project pipeline. Shore Africa

Namibia — $59m sulphuric acid plant: A new Walvis Bay facility will support uranium/copper value chains as critical minerals output scales—tangential to energy, but material for nuclear fuel and copper demand. Reuters

Policy & Regulation

Kenya — Fuel price caps (Sept 15–Oct 14): EPRA published updated maximum retail petroleum prices, shaping downstream cost pressures and generation pass-throughs. EPRA

Macro oil backdrop turns looser. OPEC+ has guided incremental output from October, and the IEA's latest Oil Market Report points to a growing surplus—supportive for net importers; a revenue headwind for crude exporters.

What we're watching next

The Development Bank of Southern Africa (DBSA) opens a call for technical transaction advisors and experts for the Independent Power Producers Procurement Programme Office (IPPO) for a five-year term. DBSA

South Africa's procurement mechanics: clarity on scale/siting (Duynefontein/Thyspunt), PBMR restart scope, fuel-cycle capex sequencing, and how the 10 GW vision interacts with the paused 2.5 GW track.

Policy & price signals: Markets will digest OPEC+'s October supply adjustments and last week's IEA Oil Market Report—implications for Algeria/Libya realizations and for importers' pump-price trajectories in the next cycle.

Ghana — Second pricing window opens (from Sept 16): Market trackers see upside risk on petrol and diesel due to FX—watch OMC notices and retail board moves mid‑week.

Sept 17–19 — KenGen Sustainable Energy Conference (Olkaria, Kenya): Expect geothermal expansion updates, new wheeling/industrial offtake MoUs, and grid‑flex topics tied to regional trade.

Was this email forwarded to you? Don't miss out on future stories — Subscribe to Electron Afrik and get your weekly Insider analysis of Africa's energy markets.