Nigeria’s Energy Transition Through the Lens of Capital and Control

How Capital Is Positioning Across Gas, Power, and Distribution in Nigeria’s Energy Transition

This piece marks EI’s first deep-dive analysis. Alongside our ongoing analytical work, we will periodically publish longer-form pieces that synthesise transactions, capital movements, and system-level shifts to examine execution risk and investor behaviour across Africa’s energy transition. This article sets the tone for that approach.

In the closing days of 2025, several large control transactions spanning gas infrastructure, power generation, and electricity distribution were executed in Nigeria. Individually, they reflect established infrastructure investment logic. Viewed together, they offer a clearer signal of how capital is positioning for the country’s energy transition through ownership, consolidation, and system control.

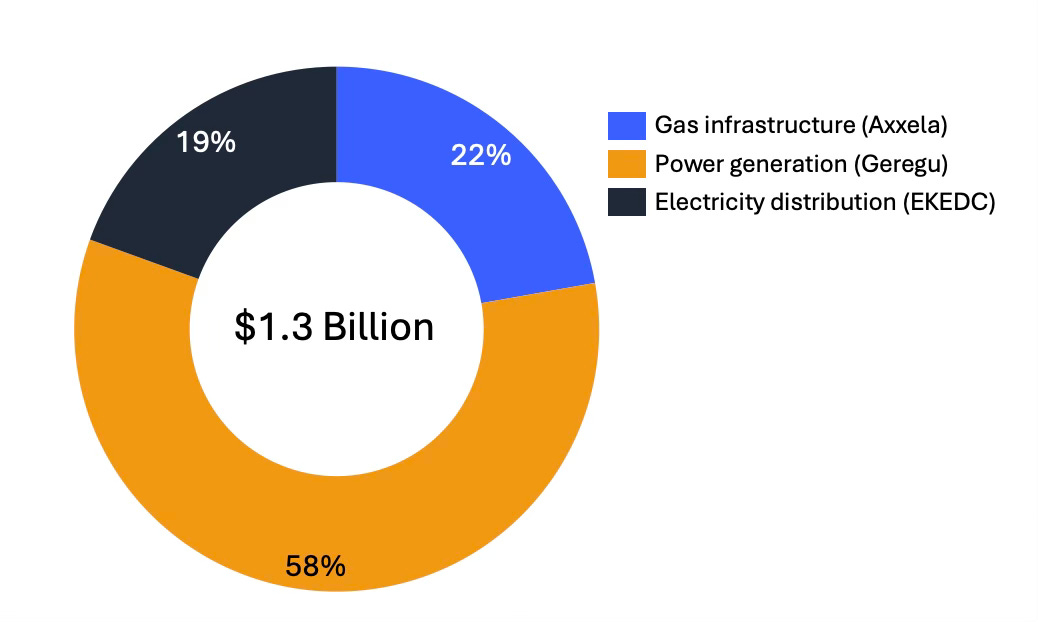

In aggregate, these transactions involve about $1.3 billion in disclosed transaction value and acquisition financing across Nigeria’s energy system. The deals include: BlueCore InfraCo’s $285 million acquisition financing for Axxela, MA’AM Energy’s $750 million acquisition of control in Geregu Power via Amperion Power and Transgrid Enerco’s $250 million (₦360 billion) purchase of a 60 percent stake in Eko Electricity Distribution Company (EKEDC).

Rather than signalling a rush toward new capacity, the sequencing points to a transition being financed through optimisation of existing assets, particularly those linked to gas supply, power reliability, and industrial demand.

Transition Capital Is Entering at the Control Layer, Not the Build Phase

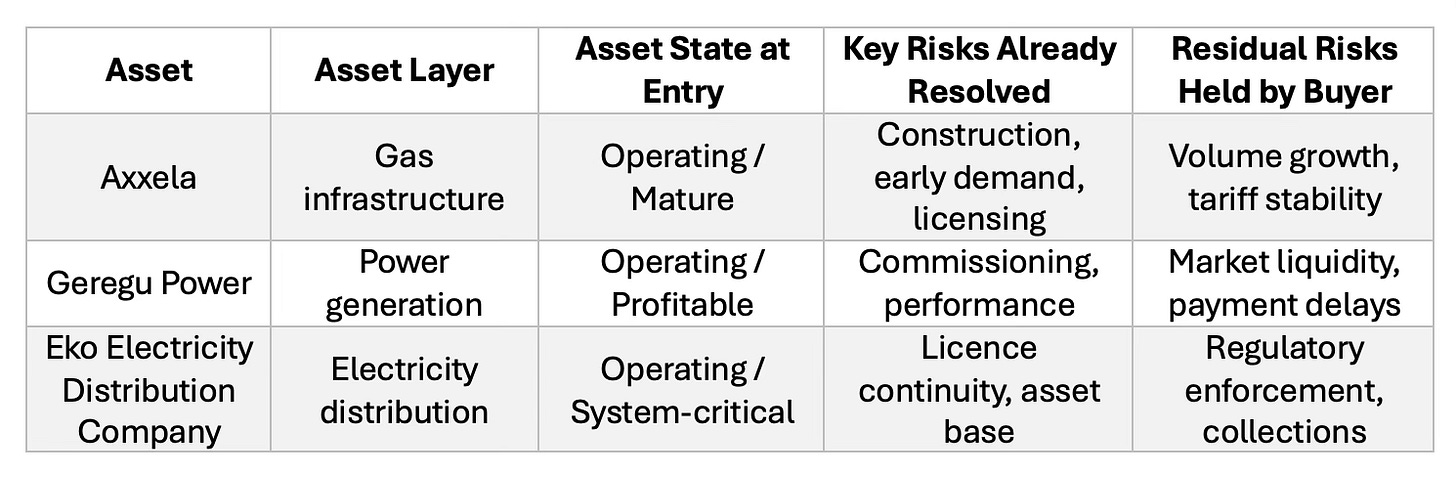

Across recent transactions, this positioning is expressed through the acquisition of control stakes in operating assets rather than the financing of new capacity. Recent ownership changes span mature gas infrastructure, established gas-fired generation, and electricity distribution, all already embedded within Nigeria’s energy system.

This sequencing matters. Rather than underwriting construction risk, commissioning uncertainty, or early-stage regulatory exposure, capital is being deployed where assets are built, licensed, and cash-generating. The transition, in this framing, is not being financed through greenfield substitution but through reconfiguration of ownership over existing system-critical assets.

Why now?

The timing of these transactions warrants closer examination. In each case, sellers exited after extended periods of asset stabilisation, while buyers entered once operating risk, regulatory treatment, and cash-flow behaviour were observable rather than theoretical.

It is also notable that these acquisitions are being executed by domestic and regionally anchored players rather than global generalist capital. The acquiring parties are operators and infrastructure platforms with existing exposure to Nigeria’s energy system, supported largely by local and regional financing. This matters because it places currency, regulatory, and execution risk on balance sheets structurally better positioned to absorb them, helping explain why control transactions are clearing at scale.

Gas Is Being Treated as System Infrastructure, Not a Bridging Asset

The acquisition of Axxela by BlueCore InfraCo is frequently described in transition terms, but the transaction mechanics are more revealing than the transition narrative surrounding it. The asset being acquired is a licensed gas distribution platform with physical pipeline infrastructure, long-standing industrial customers, and an established role in supplying gas for power and industrial use.

Gas, in this context, is treated as foundational infrastructure within the transition, enabling displacement of diesel, stabilisation of power supply, and coordination across industrial demand.

This treatment of gas aligns with Nigeria’s policy stance, but more importantly, it demonstrates that investors view gas assets as capable of supporting long-term capital structures, not as temporary or stranded positions.

Platform Logic: Why Axxela’s Dual Role Matters

A key, and often overlooked, signal emerges when Axxela’s role is examined beyond its own acquisition. Pre-acquisition, Axxela was also part of the consortium behind Transgrid Enerco, which has now acquired a controlling stake in EKEDC.

While this overlap does not imply coordination, it highlights how certain operating platforms already sit across multiple layers of the energy system. Axxela holds exposure across gas supply, power generation adjacency, and electricity distribution control, albeit through different ownership vehicles.

From a transition perspective, this suggests investors are not simply buying assets aligned with gas policy but are stacking control across interconnected layers of the energy value chain. Gas infrastructure becomes more valuable when it is proximate to demand aggregation and grid access. Distribution assets become more strategic when paired with fuel supply and embedded generation capability.

Bankability is Emerging at the Later Stage of the Lifecycle

The sale of control in Geregu Power provides further evidence of where bankability is currently clearing. The transaction involved the transfer of control at the holding level of a fully operational, profitable, gas-fired generation asset, financed by domestic banks and executed without altering the public market structure of the listed company.

This matters because it demonstrates that later-stage power assets in Nigeria can support large equity exits and significant debt financing, provided operating performance, contractual arrangements, and regulatory treatment are already established.

Taken alongside the gas and distribution transactions, a consistent pattern is observable: in recent large-ticket control transactions, capital has entered where assets are already operating within existing constraints. Construction risk, market design uncertainty, and first-of-a-kind exposure are notably absent from transactions of this scale.

What the Deals Signal About Investor Positioning

Collectively, these deals suggest that investors are positioning for Nigeria’s energy transition through control, consolidation, and adjacency, rather than through direct technology bets. Transition exposure is being achieved by owning and coordinating assets that already underpin the energy system, particularly those linked to gas, power reliability, and industrial demand.

This positioning reflects an implicit assessment that Nigeria’s transition will be path-dependent, evolving through optimisation of existing infrastructure before large-scale substitution becomes financeable at system level.

Relevance for Investors in Nigeria’s Energy Sector

For investors evaluating Nigeria from a transition standpoint, the relevance of this analysis lies in understanding where capital is demonstrably deployable today. The evidence points to operating platforms, control transactions, and assets capable of interfacing across multiple layers of the energy system.

The transition signal is not found in technology labels, but in capital structure, ownership sequencing, and system positioning. Investors who can operate at these intersections appear better aligned with how Nigeria’s transition is currently being financed.

From an energy transition lens, these deals do not define the endpoint. They define the current clearing price of risk.